U.S. 503A and 503B Compounding Pharmacies Market Competitive Landscape and Future Outlook – A Report by Towards Healthcare

This report published by Towards Healthcare, a sister firm of Precedence Research, provides a comprehensive competitive analysis of the U.S. 503A and 503B Compounding Pharmacies Market, highlighting key developments, regulatory frameworks and market dynamics shaping the industry outlook for 2024 and beyond.

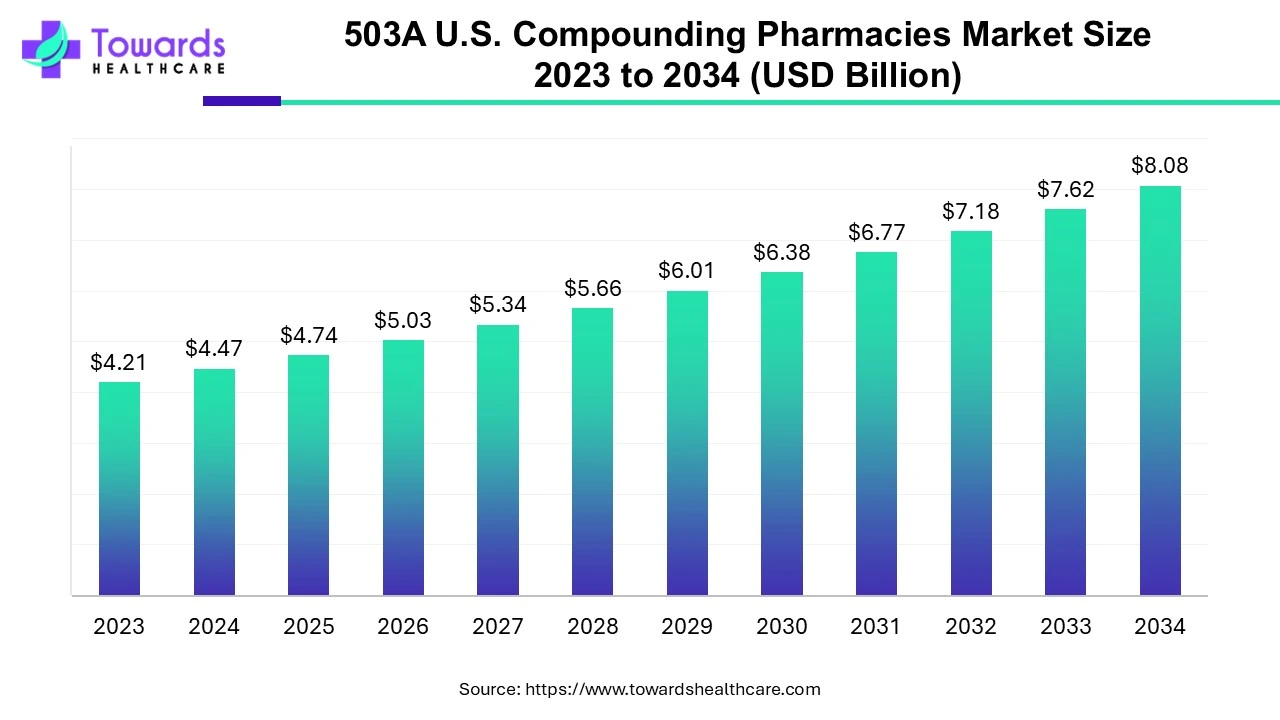

Ottawa, Oct. 08, 2025 (GLOBE NEWSWIRE) -- 503A U.S. Compounding Pharmacies Market Growth

The global 503A U.S. compounding pharmacies market size was valued at USD 4.47billion in 2024 and is predicted to hit around USD 8.08 billion by 2034, rising at a 6.11% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5070

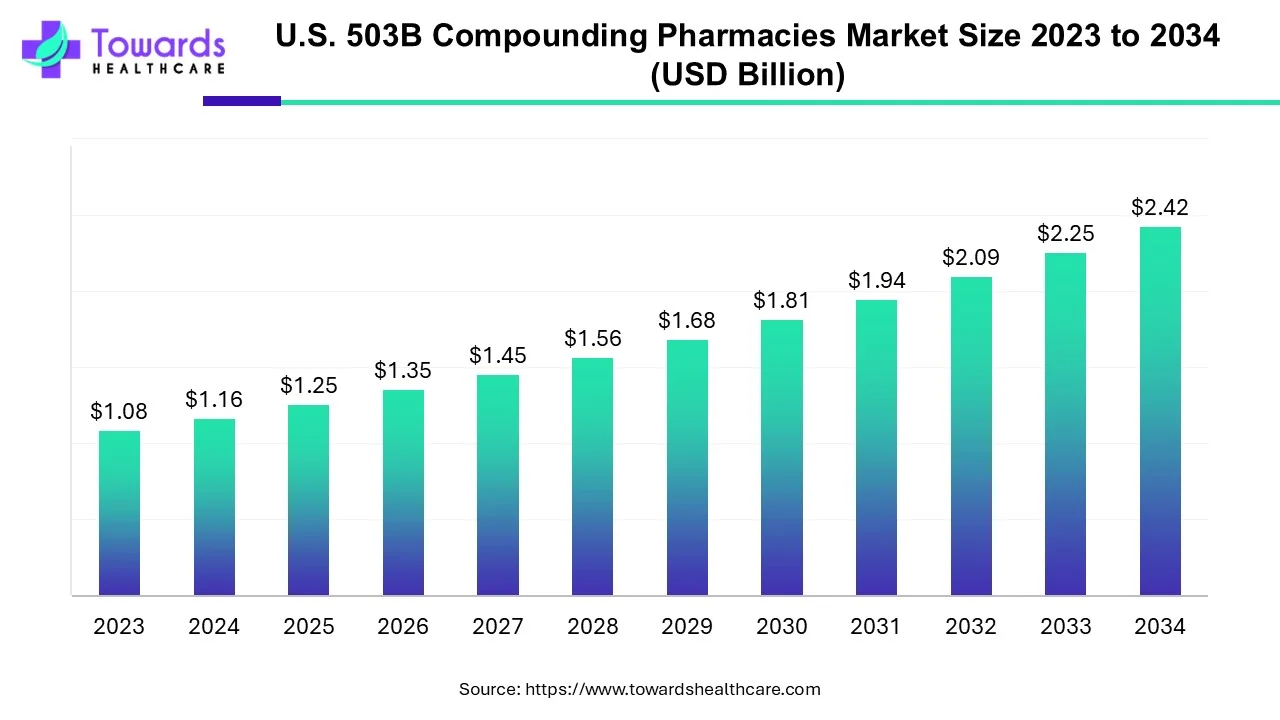

503B U.S. Compounding Pharmacies Market Growth

The global U.S. 503B compounding pharmacies market size is calculated at USD 1.25 billion in 2025 and is expected to reach around USD 2.42 billion by 2034, growing at a CAGR of 7.63% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5386

Key Takeaways

- By product, the oral segment led the U.S. 503A compounding pharmacies market in 2024.

- By product, the rectal segment is expected to grow fastest during the forecast period.

- By therapeutic area, the pain management segment captured a notable share of the U.S. 503A compounding pharmacies market in 2024.

- By therapeutic area, the hormone replacement segment is expected to be the fastest-growing in the coming years.

- By product type, the sterile compounded drugs segment was dominant in the U.S. 503B compounding pharmacies market in 2024.

- By product type, the non-sterile compounded drugs segment is expected to grow rapidly during 2025-2034.

- By therapeutic application, the pain management segment dominated the U.S. 503B compounding pharmacies market in 2024.

- By therapeutic application, the oncology segment is expected to witness the fastest growth in the predicted timeframe.

What are the U.S. 503A and 503B Compounding Pharmacies?

The U.S. 503A pharmacies include the preparation of drugs based on each patient's prescriptions under state oversight, whereas 503B develops outsourcing facilities for larger batches of compounded drugs under stringent FDA oversight and cGMP standards. The U.S. 503A and 503B compounding pharmacies market is mainly fueled by an accelerating demand for customized medicine, increasing chronic disease rates, and frequent lack of commercial drugs. Last year, they introduced a national wholesale service, with a raised emphasis on the supply chain and regulation of compounded drugs including GLP-1s, and efforts by the FDA to clarify and impose rules for both types of facilities.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Differences Between 503A and 503B Compounding Pharmacies:

| Aspect | 503A Compounding Pharmacies | 503B Outsourcing Facilities |

| Primary Purpose | Compounding medications for individual patients based on prescriptions | Compounding large batches of sterile drugs for healthcare facilities |

| Prescription Requirement | Required – Must have a patient-specific prescription | Not required – Can compound in anticipation of orders |

| Regulatory Authority | Regulated by state boards of pharmacy and FDA (limited) | Regulated by the FDA under Section 503B of the FDCA |

| Inspection Frequency | Inspected mainly by state authorities | Subject to routine FDA inspections |

| Sterile Compounding | Allowed but under USP <797> standards | Must comply with cGMP (Current Good Manufacturing Practices) |

| Facility Registration | No FDA registration as outsourcing facility | Must register with FDA as an outsourcing facility |

| Labeling Requirements | Follows state-level labeling rules | Must meet FDA labeling requirements, including batch info, ingredients |

| Volume & Distribution | Compounds for individual use only | Can distribute in bulk to healthcare providers nationwide |

| Insurance & Liability | Typically smaller operations with limited liability coverage | Larger facilities with higher liability standards |

| Use in Hospitals & Clinics | Limited due to patient-specific need | Widely used in hospitals and clinics for office use medications |

Key Trends in the U.S. 503A and 503B Compounding Pharmacies Market

- In January 2025, the FDA’s guidance, titled Interim Policy on Compounding Using Bulk Drug Substances Under Section 503A of the Federal Food, Drug, and Cosmetic Act, highlights specific settings under which pharmacies can compound medications employing bulk drug substances.

- In December 2024, L RockRx Compounding Pharmacy, a new 503A compounding pharmacy, held its grand opening for its new facility in Little Rock, which is estimated to establish around 100 jobs.

- 503B facilities carry an alliance with medical equipment manufacturers to accelerate production capacity and optimize access to specific products for hospitals.

- In October 2024, Valor Compounding Pharmacy, a significant provider of compounded medications, announced its expansion and opportunity for new collaborations with medical practices and health systems.

What is the Emerging Challenge in the Market?

The U.S. 503A develops regulatory inconsistency, as well as variations in quality standards for inspections and compounding practices from state to state. Whereas, 503B demands to meet stricter cGMP requirements similar to those of large manufacturers. This further expands the expenditure of initial facility setup, continuous compliance, and quality testing is a critical hurdle to entry.

U.S. 503A and 503B Compounding Pharmacies Market: Notable Initiatives

- In September 2025, Representatives Diana Harshbarger and Buddy Carter unveiled legislation intended to strengthen compounding pharmacies to tackle drug shortages.

- In September 2025, more than 60 organizations, particularly technology leaders like Apple, Google, and Amazon, alongside health care giants, including CVS Health and UnitedHealth Group, have signed on to participate. This will further focus on diabetes, weight management, and medication tracking, which have direct implications for pharmacies, and applications of QR codes and conversational artificial intelligence (AI).

- In September 2025, the U.S. Food and Drug Administration (FDA) and U.S. Department of Health and Human Services (HHS) announced the widespread initiative to "rein in misleading direct-to-consumer pharmaceutical advertisements."

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Major Segments of the U.S. 503A and 503B Compounding Pharmacies Market

By product analysis

Which Product Led the U.S. 503A Compounding Pharmacies Market in 2024?

The oral segment held a major share of the market in 2024. The segment is mainly propelled by a rise in patient-specific requirements, like allergies, unavailable dosages, and difficulty swallowing pills. 503A is focusing on allergy-specific formulations, unique dosage strengths, and combination drugs for complex chronic concerns, particularly cancer, diabetes, and heart disease. In 2024, the FDA approved various oral products, such as Acetyl L-carnitine, Alpha-lipoic acid, Coenzyme Q10, and Curcumin.

Whereas, the rectal segment is anticipated to register significant expansion during 2025-2034. These kinds of products offer minimized first-pass metabolism with expanded targeted local treatment, and are advantageous for a broader range of geriatric & pediatric populations. Ongoing developments are exploring thermosensitive liquid suppositories, mucoadhesive preparations, & nanoparticulate systems. Currently, 503A includes hemorrhoid and anal fissure suppositories, and other custom-formulated rectal preparations for conditions like chronic pain.

By therapeutic area analysis

How did the Pain Management Segment Dominate the Market in 2024?

In 2024, the pain management segment held a lucrative share of the U.S. 503A compounding pharmacies market. The growing instances of chronic pain, limitations of mass-produced medications, and the rising demand for personalized medicine are supporting pain management solutions. Nowadays, the independent community pharmacies and physician-affiliated practices are leveraging topical pain creams, suspensions, or injections with combinations of ingredients to highlight specific patient requirements for chronic pain, fibromyalgia, or migraines.

On the other hand, the hormone replacement segment is estimated to register rapid expansion. A prominent catalyst is that these pharmacies are specializing effects the creation of customized bioidentical hormone replacement therapy (BHRT) medications personalized to individual patients. Alongside, the growing aging population associated with diverse hormonal imbalance concerns, like menopause and andropause, is demanding novel hormone replacement approaches.

By product type analysis

Which Product Type Led the U.S. 503B Compounding Pharmacies Market in 2024?

The sterile compounded drugs segment registered dominance in the market in 2024. The segment is mainly driven by the accelerated use of prefilled syringes and premixed bags by developed & developing hospitals, which are often established in bulk by 503B facilities. These facilities further provide cost reduction during the outsourcing and with lower drug expenses. As the globe is focusing on raising awareness regarding health concerns, safety is supporting 503B, where the FDA has given warnings and recalls due to manufacturing deficiencies, describing the regulatory risks in the last few years.

Whereas the non-sterile compounded drugs segment will expand at the fastest CAGR. Inclusion of those products, where there is no need to maintain sterility conditions, like oral and topical formulations, especially capsules, solutions, suspensions, ointments, creams, and suppositories, is bolstering the segmental expansion. Ongoing transformations in procedures and treatments that are moving towards outpatient settings, specifically ambulatory surgical centers, are boosting demand for a readily available supply of non-sterile compounded drugs.

By therapeutic application analysis

Why did the Pain Management Segment Dominate the Market in 2024?

By capturing the biggest share, the pain management segment was dominant in the U.S. 503B compounding pharmacies market in 2024. Eventually, 503B outsourcing facilities are producing tailored pain medications for patients with specific needs, compounded topical gels and creams used in arthritis, diabetic neuropathy, and fibromyalgia, and the rising opioid crisis. SCA Pharma, Wells Pharma, and Fagron Sterile Services are widely involved in the development of sterile analgesics that are more efficacious in pain management.

However, the oncology segment is expected to anticipated to expand rapidly during 2025-2034. An expanding demand for tailored medicine, the shortage of commercially available drugs, and escalated regulatory oversight encourage the use of sterile, FDA-registered outsourcing facilities. STAQ Pharma, Revelation Pharma, and Asteria Health are empowering the production of sterile injectable oncology medications in bulk to help hospitals and clinics. For these products, 503B facilities offer regular, risk-based inspections by the Food and Drug Administration (FDA); they continue under higher safety and quality standards.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

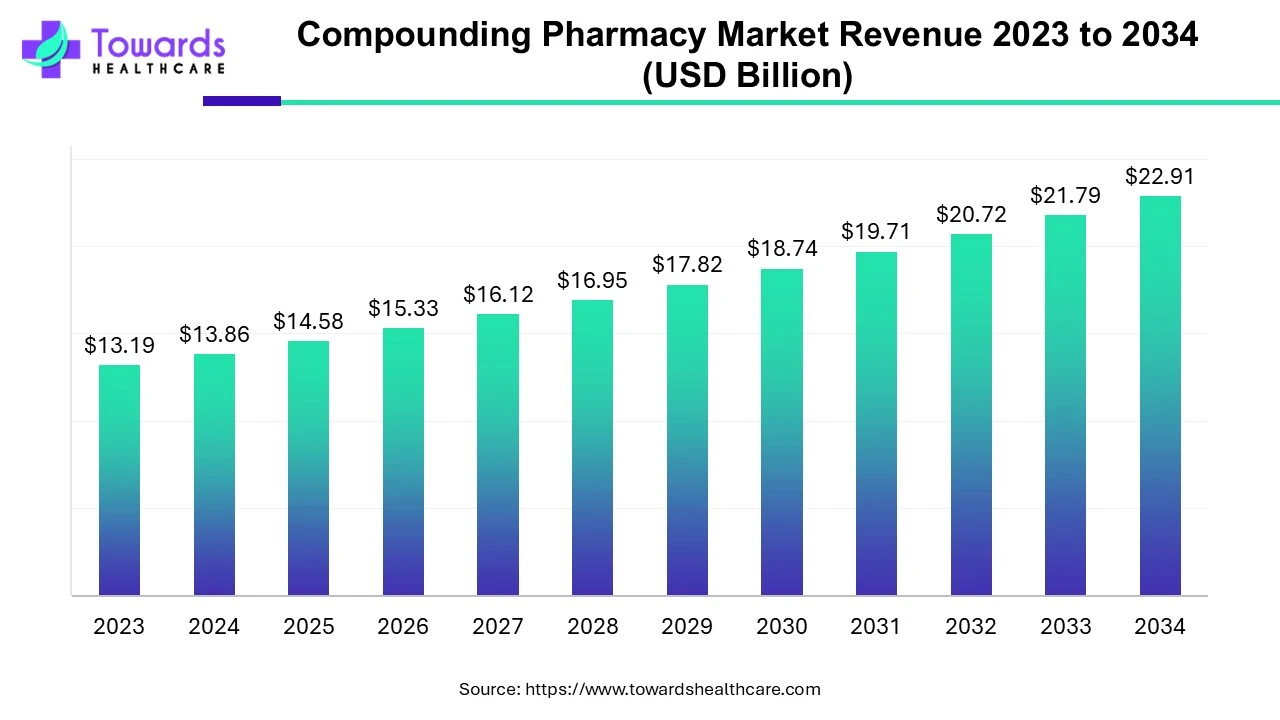

Compounding Pharmacy Market Growth

The global compounding pharmacy market size was estimated at US$ 13.19 billion in 2023 and is projected to grow to US$ 22.91 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.15% from 2024 to 2034. The growing demand for high-quality and highly-specified medicines is driving the growth of the market.

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/5338

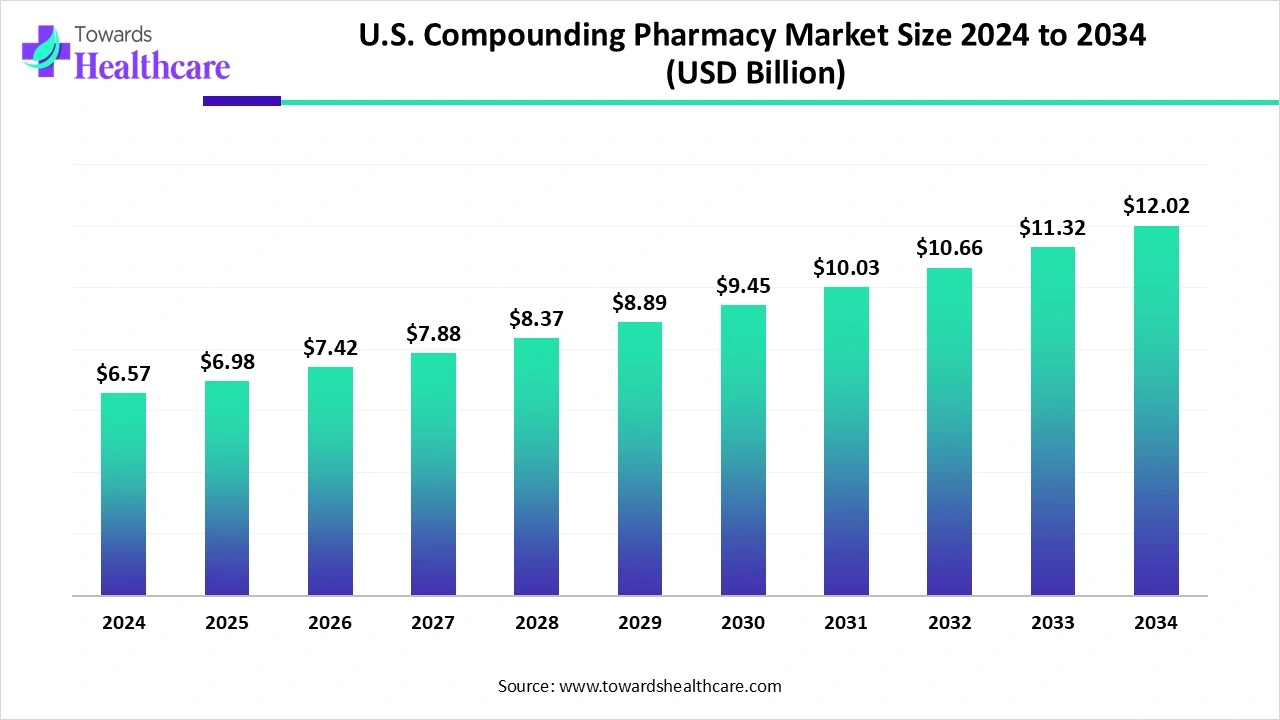

U.S. Compounding Pharmacy Market Growth

The U.S. compounding pharmacy market size in 2024 was US$ 6.57 billion, expected to grow to US$ 6.98 billion in 2025 and further to US$ 12.02 billion by 2034, backed by a robust CAGR of 6.24% between 2025 and 2034.

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/6201

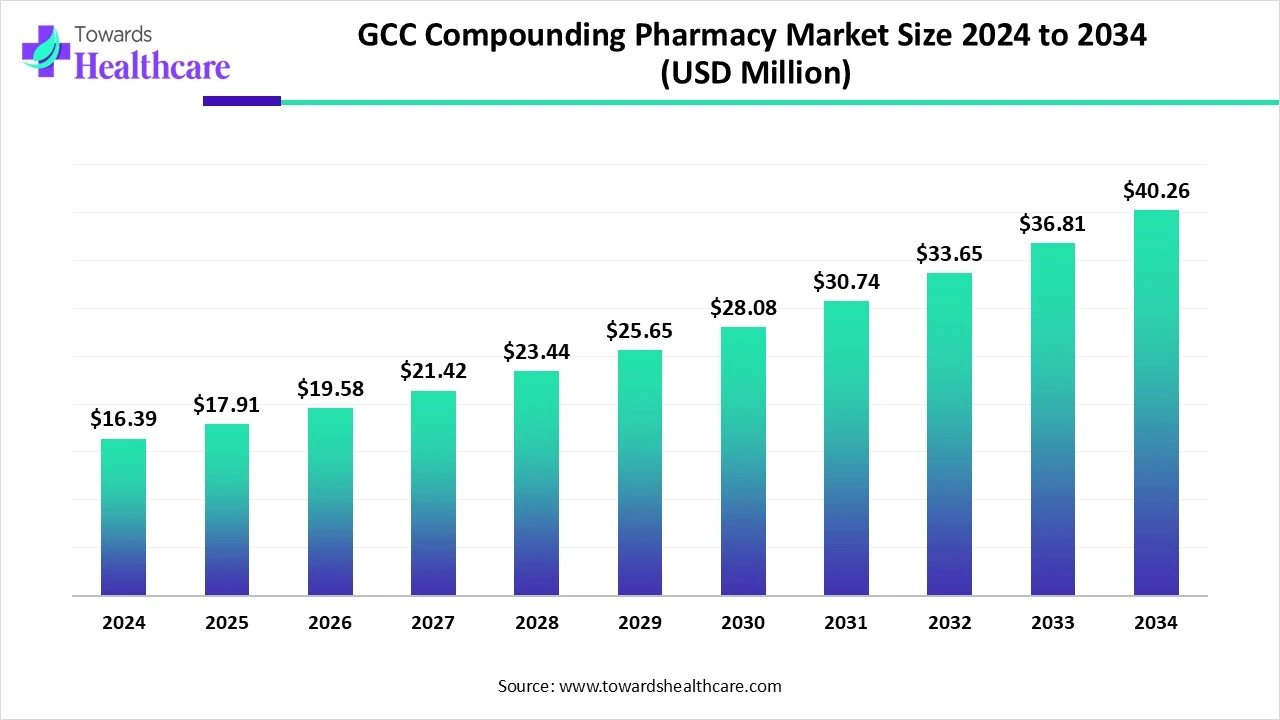

GCC Compounding Pharmacy Market

The global GCC compounding pharmacy market size is calculated at USD 16.39 million in 2024, grew to USD 17.91 million in 2025, and is projected to reach around USD 40.26 million by 2034. The market is expanding at a CAGR of 9.27% between 2025 and 2034.

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/5898

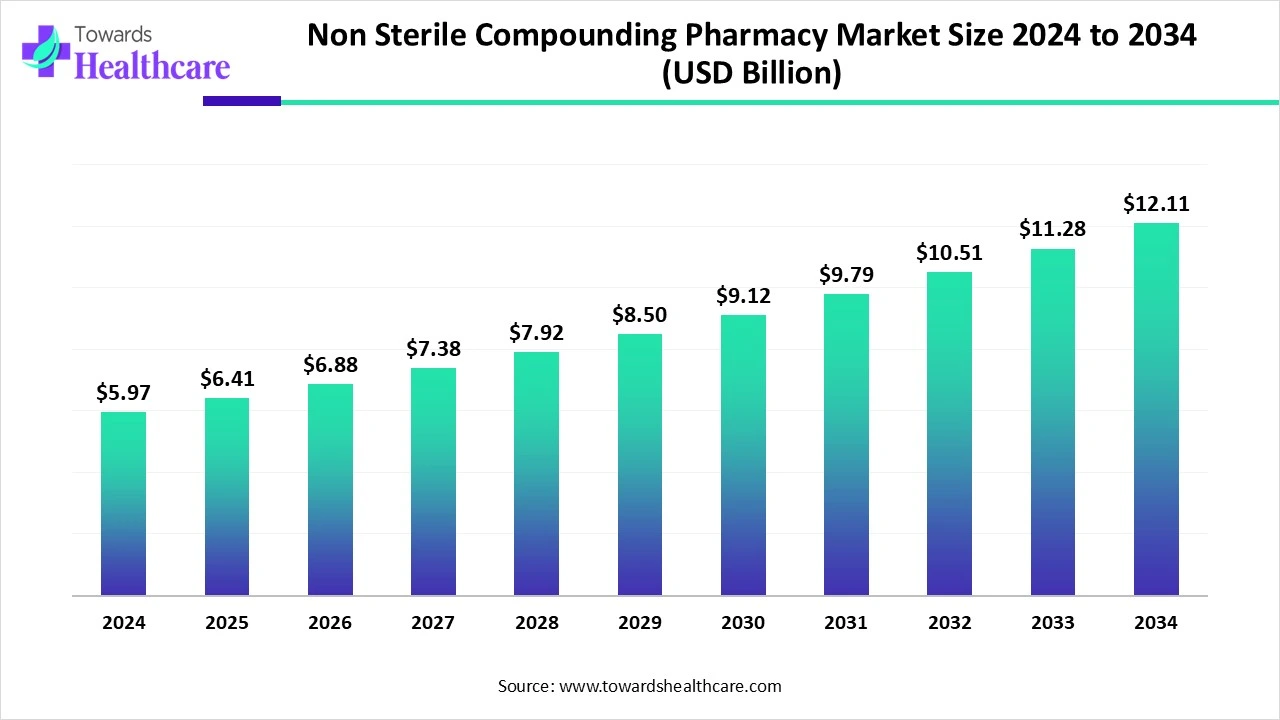

Non-Sterile Compounding Pharmacy Market Size, Trends and Shares (2025 - 2034)

The global non-sterile compounding pharmacy market size is calculated at US$ 5.97 billion in 2024, grew to US$ 6.41 billion in 2025, and is projected to reach around US$ 12.11 billion by 2034. The market is expanding at a CAGR of 7.34% between 2025 and 2034.

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/price/5864

Recent Developments in the U.S. 503A and 503B Compounding Pharmacies Market

- In September 2025, LifeMD, Inc., a major provider of virtual primary care services, expanded its state-of-the-art affiliated pharmacy to include advanced non-sterile compounding capabilities for oral and topical medications.

- In June 2025, Olympia Pharmaceuticals, the nation’s leading 503A and 503B compounding pharmacy, launched its new consumer-focused platform, OlympiaYou.com, a new digital platform developed to make wellness and sexual health more accessible, inclusive, and easy to understand.

- In January 2025, Revelation Pharma, a leading national network of 503A and 503B compounding pharmacies, introduced its new animal-focused division, Revelation Animal Health, a devoted arm emphasizing service to the unique health needs of animals across the nation.

Case Study for U.S. 503B Compounding Pharmacies Market

Case Study: SCW.AI by Supply Chain Wizard & Asteria Health Transform 503B Pharmaceutical Manufacturing with Data-Driven Innovation

At Towards Healthcare, we track key innovations in pharma.

In August 2025, SCW partnered with 503B leader Asteria Health to launch a next-gen, data-driven manufacturing site in Birmingham, Alabama.

This strategic partnership marks a milestone in the 503B compounding landscape, merging SCW’s cutting-edge Digital Factory Platform with Asteria Health’s commitment to operational excellence, scalability, and uncompromising quality.

Challenges Faced

● The 503B outsourcing sector has been constrained by manual processes, limited automation, and data silos affecting production consistency and compliance.

● Quality assurance and regulatory alignment in large-scale sterile compounding have been complex and resource-intensive.

Solutions Implemented

● Integration of SCW’s Digital Factory Platform, designed to unify data streams across manufacturing operations for real-time monitoring and predictive insights.

● Deployment of advanced analytics and AI-driven process optimization tools to improve efficiency, traceability, and compliance.

● Implementation of smart manufacturing frameworks to ensure reproducibility, minimize human error, and enhance transparency.

Key Results & Outcomes

● Establishment of a state-of-the-art manufacturing facility in Birmingham focused on data-driven compounding excellence.

● Enhanced production efficiency and regulatory compliance through continuous data monitoring and digital validation.

● A new industry benchmark for innovation and operational precision in 503B outsourcing.

● Strengthened collaboration model that combines technology leadership (SCW) with pharmaceutical expertise (Asteria Health).

Strategies & Next Steps

● Continuous scaling of the Digital Factory infrastructure to accommodate new product lines and capacity expansion.

● Fostering cross-functional training programs to upskill personnel in digital manufacturing technologies.

● Leveraging data intelligence to drive predictive maintenance, process optimization, and sustainable production practices.

About This Case Study

● This case study is based on dedicated research and market intelligence by the Towards Healthcare team.

● We provide in-depth analyses of emerging technologies, strategic partnerships, and evolving market dynamics shaping the global healthcare ecosystem.

If you require customized insights, market-specific data, or personalized case studies tailored to your organization’s goals, our team is ready to assist.

For Detailed Case Studies On Specific Products, Recent Launches, Market Segments, Industry Challenges, Or Competitor/Company Analysis, Please Email Us At:

sales@towardshealthcare.com

Key Players List

- Triangle Compounding

- Fagron

- B. Braun SE

- Pencol Specialty Pharmacy

- Vertisis Custom Pharmacy

- Optum Inc

- Pavilion Compounding Pharmacy, LLC.

- Village Compounding Pharmacy

- McGuff Compounding Pharmacy

- Wedgewood Pharmacy

- SCA Pharma

- Nephron Pharmaceuticals Corporation

- Athenex, Inc.

- Wells Pharma of Houston LLC

- Olympia Pharmacy

- Fagron Compounding Pharmacies

U.S. 503A and 503B Compounding Pharmacies Market

By Product

- Oral

- Liquid Preparations

- Topical

- Rectal

- Ophthalmic

- Nasal

- Otic

By Therapeutic Area

- Hormone replacement

- Pain management

- Dermatology

- Pediatrics

- Urology

- Others

By Product Type

- Sterile Compounded Drugs

- Non-sterile Compounded Drugs

By Therapeutic Application

- Pain Management

- Hormone Replacement Therapy (HRT)

- Oncology

- Ophthalmology

- Infectious Disease Treatment

- Cardiology

- Gastroenterology

- Nutritional Infusions

- Pediatrics

- Dermatology

503A U.S. Compounding Pharmacies Market: Immediate Delivery Available | Buy This Premium Research https://www.towardshealthcare.com/price/5070

U.S. 503B Compounding Pharmacies Market: Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5386

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.